|

Phone: 877-253-7686 Email: info@globalfundingexperts.com Learn More |

Since: November 2018 Since: November 2018 |

Stories

Latin Financial Launches First Lending Podcast in ‘Spanglish’

February 4, 2022 In an inaugural move for small business financing this week, Latin Financial launched the first ‘Spanglish’ podcast for funders, lenders, merchants, and brokers titled the Latin Financial Podcast. Hosted by the company’s CEO Sonia Alvelo and co-hosted by Underwriter Ruth Alustiza, Latin Financial hopes to create an open forum of discussion and education about how Latino-owned businesses can get access to different types of financial products; all in two different languages.

In an inaugural move for small business financing this week, Latin Financial launched the first ‘Spanglish’ podcast for funders, lenders, merchants, and brokers titled the Latin Financial Podcast. Hosted by the company’s CEO Sonia Alvelo and co-hosted by Underwriter Ruth Alustiza, Latin Financial hopes to create an open forum of discussion and education about how Latino-owned businesses can get access to different types of financial products; all in two different languages.

“It was so much fun, but so scary,” said Alvelo, when asked about her experience recording on her first episode. “[I’m doing this] to make sure the merchants and clients have and will have the right information, I know I’m breaking barriers of languages, it’s the right thing to do.”

While still in its infancy, Alvelo is expecting the show to take off. Her target audience among merchants is a growing group of Latino-owned small businesses who have been historically underbanked. Offering episodes in both English and Spanish, the podcast hopes to not only educate the show’s listeners on how small business lending works, but also hopes to serve as a crash course in either Spanish or English for those who are already members of the non-bank finance world.

The show will have funders, lenders, merchants, and staff of Latin Financial on as guests, according to Alvelo. The show has begun a stream of content that will be released on a regular basis that is being uploaded on platforms like Apple Podcasts, Google Podcasts, and Spotify.

“We are doing one episode per week, said Alvelo. “We’re going to add guests, they are already asking me to attend, and lenders. I’ll be doing back and forth, Spanish and English for sure.”

Alvelo seems confident that the show can separate itself from the countless other finance podcasts that exist. With a dynamic of two languages, two cultures, complex financial products, and revolving guests, it seems as if Latin Financial has discovered a niche in the business media space. “The audience can listen in Spanglish about what we do to help business owners in the United States and Puerto Rico. It’s a new way to stay informed, get educated on updated programs in the financing Industry, all in two languages,” Alvelo said. “It’s Spanish and English, equals Spanglish!”

A weblink to the show can be found here.

Crypto Fans Want to Buy The Constitution of the United States and They Might Actually Succeed

November 15, 2021

It’s the ultimate NFT, the Constitution of the United States. On November 18th, Sotheby’s will auction off one of the only thirteen surviving copies of the United States Constitution, an opportunity the public hasn’t had since 1988.

But a private collector hoping to pocket the national treasure will have some competition, the crypto mob on twitter. On November 11th, at least two individuals launched @ConstitutionDAO, a twitter account dedicated to crowdfunding crypto with the intent of raising enough money to be the winning bid.

The buyer would technically be a DAO, a Decentralized Autonomous Organization, a community-led entity with no central authority that is governed by a smart contract.

It’s predicted that if the DAO can raise significant cash before the auction that Sotheby’s will allow it to place legitimate bids. Sotheby’s put the estimated winning bid price at $15 million – $20 million.

It might not be out of reach, the DAO raised nearly $2 million in just the few hours since it began crowdfunding the money through a platform called juicebox.

If the DAO wins, theoretically “ownership” of the constitution would be fractionalized into shares based upon each member’s contribution. With a DAO, no one need even disclose who they are. Only a crypto address is required.

We have coordinated a DAO to acquire The Constitution of the United States.

I give you: @ConstitutionDAO

Ping me if interested in being a part of a monumental moment. https://t.co/VHkCTrq4fa

— Austin Cain (📜,📜) (@j_austincain) November 12, 2021

Members contributing to the pool of funds have the option of including a public message.

“To secure the blessings of liberty”

“Another first generation immigrant hoping to be the proud owner of the US constitution.”

“American Dream!!!”

“cant wait to explain this at Thanksgiving”

“in satoshi we trust”

The official website of the ConstitutionDAO is here.

For the sake of following the success or failure of this project accurately, deBanked contributed a very small amount to the DAO so that it could participate in the possible ownership and community of the Constitution. Weird, I know.

El Salvador Becomes First Bitcoin Nation as 70% of Country Remains Unbanked

September 7, 2021 With over $20 million in Bitcoin, the El Salvadorian government is set to put the basis of their already crumbling economy on the back of the world’s most sought-after cryptocurrency. President Naykib Bukele took to Twitter over the weekend to boast about his country’s unprecedented economic shift in a time when 70% of residents lack access to traditional financial services.

With over $20 million in Bitcoin, the El Salvadorian government is set to put the basis of their already crumbling economy on the back of the world’s most sought-after cryptocurrency. President Naykib Bukele took to Twitter over the weekend to boast about his country’s unprecedented economic shift in a time when 70% of residents lack access to traditional financial services.

In a country where roughly half of its population has no internet access, the government has released a state-sponsored app (called Chivo Wallet) that will allow its citizens to buy goods using Bitcoin the government owns. Mostly dominated by the US Dollar, the local economies of El Salvador will now be forced to accept Bitcoin as legal currency.

Each citizen who uses Chivo will be given $30 worth of Bitcoin to jumpstart the spending.

Buying the dip 😉

150 new coins added.#BitcoinDay #BTC🇸🇻

— Nayib Bukele 🇸🇻 (@nayibbukele) September 7, 2021

The move has faced backlash from all different types of groups including economists, politicians, and investors. The world is watching to see if this shift in currency will help pull the country out of its troubles, or if it is more public relations posturing — at the expense of the El Salvadorian economy.

The United States top official in El Salvador, Jean Manes, referred to the nation at a press conference Saturday as “a democracy in decline” as the move is just one of a handful of that technically increase the power of the federal government in the small country. Manes compared Bukele to the likes of Hugo Chávez, using his notoriety with the population to cover up a strategic economic collapse and dismantling of democracy.

The El Salvadorian embassy did not immediately respond to a request for comment.

The value of Bitcoin dropped by 15% against the US dollar on the day of its debut.

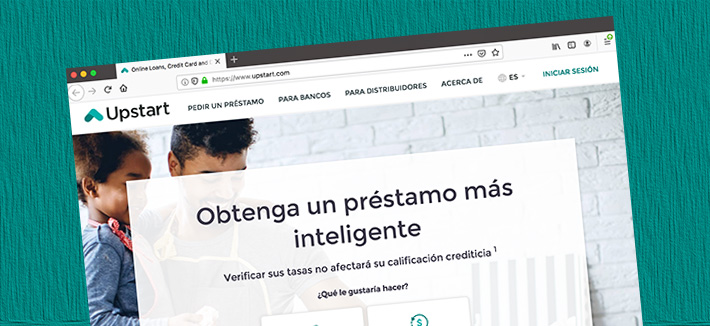

Upstart Launches First Spanish Digital Lending Platform

September 1, 2021 One of the nation’s top artificial intelligence lending platforms announced Tuesday that they will be operating the first ever online lending platform in Spanish. Upstart will mimic its English platform with full access to loan information, borrowing tools, loan agreements, and customer support for Spanish speaking customers.

One of the nation’s top artificial intelligence lending platforms announced Tuesday that they will be operating the first ever online lending platform in Spanish. Upstart will mimic its English platform with full access to loan information, borrowing tools, loan agreements, and customer support for Spanish speaking customers.

“Inclusion often starts with language,” said Dave Girouard, co-founder and CEO, to deBanked. “We founded Upstart with the belief that better technology could improve access to affordable credit. While better AI models are the primary lever we use to create a more inclusive platform, they are not the only lever.

“While restaurants and retailers routinely offer a Spanish-language alternative, online lenders unfortunately do not,” Girouard continued. “Taking out a loan is a big decision and comes with important obligations, so it’s clearly better for the consumer if the entire experience, including disclosures, the loan agreement, and customer support, are available in their preferred language.”

With more than 60 million Latinos living in the United States, access to information about personal loans in another language will be able to provide more clarity and transparency for a new breed of customers who may be hesitant about lending as is.

The launch of the platform is somewhat unique, as they are introducing borrowing services to an entire demographic that is perceived as untapped. Getting access to an entire community of people by breaking a language barrier could definitely be one way to add potential borrowers to Upstart’s book of business.

This pattern of increasing qualified borrowers is nothing new for Upstart, whose business model has been to work with both banks and credit unions by examining potential borrowers on more than just raw credit scores. Work history, education, academic standing, and standardized test scores are also factors that Upstart considers when underwriting their loans.

The loans are offered exclusively through Cross River Bank, but could be offered by other institutions that work with Upstart in the near future.

Mexican Small Business Lender Buys a Bank, Eyes United States

June 18, 2021 Change is happening south of the border. Online lenders and alternative funders are growing across Mexico much the same way as elsewhere. This week, Credijusto, an online small business lender based in Mexico City, acquired Banco Finterra, marking the first time that a fintech has acquired a bank in the country.

Change is happening south of the border. Online lenders and alternative funders are growing across Mexico much the same way as elsewhere. This week, Credijusto, an online small business lender based in Mexico City, acquired Banco Finterra, marking the first time that a fintech has acquired a bank in the country.

According to Reuters, “Credijusto aims to ramp up services for Mexican companies that sell to the United States, and build a business for U.S. companies that do cross-border trade in Mexico and beyond in Latin America.”

Mexico also has more than 6 million small businesses, a market that is effecively 4-6x larger than Canada’s.

Prior to this, Credijusto had already collectively raised $400M from Goldman Sachs, Credit Suisse, Point72 Ventures, New Residential Investment Corp., Kaszek, QED Investors, John Mack, Ignia, Promecap and LIV Capital.

“The acquisition of Banco Finterra seeks to create the first truly digital banking platform for Mexican companies in the future,” commented Allan Apoj, co-CEO of Credijusto. “This transaction marks an important milestone in Mexico and the region, and we are proud to be revolutionizing the future of banking in Latin America.”

Apoj’s partner, co-CEO David Poritz, hinted to Reuters that in a couple of years it may consider the acquisition of an American bank as well.

Earlier this year, Mexico began to allow fintech companies to obtain a Financial Technology Institution license.

Estamos muy orgullosos de revolucionar el futuro de la banca en México con la adquisición de Banco Finterra y de beneficiar así a las empresas a través de productos financieros de nueva generación. Conoce más de este gran logro: https://t.co/pbGBVyo04p pic.twitter.com/A32vaHDOB1

— Credijusto (@credijusto) June 15, 2021

Amazon Now Among The Top Online Small Business Lenders in The United States

May 8, 2019

Amazon has joined PayPal, OnDeck, Kabbage, and Square as being among the largest online small business lenders. On Tuesday, Amazon revealed that it had made more than $1 billion in small business loans to US-based merchants in 2018. Amazon says the capital is used to build inventory and support their Amazon stores.

By selling on Amazon, “SMBs do not need to invest in a physical store or the costs of customer discovery, acquisition, and driving customer traffic to their branded websites,” the company says. Small and medium-sized businesses selling in Amazon’s stores now account for 58 percent of Amazon’s sales. More than 200,000 SMBs exceeded $100,000 in sales on Amazon in 2018 and more than 25,000 surpassed $1 million.

You can view the full report they published here.

| Company Name | 2018 Originations | 2017 | 2016 | 2015 | 2014 | |

| PayPal | $4,000,000,000* | $750,000,000* | ||||

| OnDeck | $2,484,000,000 | $2,114,663,000 | $2,400,000,000 | $1,900,000,000 | $1,200,000,000 | |

| Kabbage | $2,000,000,000 | $1,500,000,000 | $1,220,000,000 | $900,000,000 | $350,000,000 | |

| Square Capital | $1,600,000,000 | $1,177,000,000 | $798,000,000 | $400,000,000 | $100,000,000 | |

| Amazon | $1,000,000,000 | |||||

| Funding Circle (USA only) | $792,000,000 | $514,000,000 | $281,000,000 | |||

| BlueVine | $500,000,000* | $200,000,000* | ||||

| National Funding | $494,000,000 | $427,000,000 | $350,000,000 | $293,000,000 | ||

| Kapitus | $393,000,000 | $375,000,000 | $375,000,000 | $280,000,000 | ||

| BFS Capital | $300,000,000 | $300,000,000 | $300,000,000 | |||

| RapidFinance | $260,000,000 | $280,000,000 | $195,000,000 | |||

| Credibly | $290,000,000 | $180,000,000 | $150,000,000 | $95,000,000 | $55,000,000 | |

| Shopify | $277,100,000 | $140,000,000 | ||||

| Forward Financing | $210,000,000 | $125,000,000 | ||||

| IOU Financial | $125,000,000 | $91,300,000 | $107,600,000 | $146,400,000 | $100,000,000 | |

| Yalber | $65,000,000 |

UCS-BizBloom Deal Could Be First of Many

August 21, 2018United Capital Source (UCS) was chosen to service BizBloom’s book of business, according to UCS CEO Jared Weitz. After BizBloom’s president, Thomas Costa, stepped down, the company’s main investor assumed control and arranged for the company’s portfolio of merchants to be serviced by UCS. Weitz told deBanked that he was familiar with the BizBloom investor previously.

“When [they] reached out to me, I knew it was something we would be able to do,” Weitz said. “Between the experience of our account reps, our CRM, our technology that helps us, and our existing relationships, we knew we could take on the additional work, no problem.”

UCS will now control servicing BizBloom’s old portfolio, helping to place renewals. Weitz said he has a confidential financial arrangement with them.

“This type of arrangement is extremely common in finance,” Weitz said. “For instance, when Bizfi went out of business, Credibly was servicing their portfolio.”

While UCS is not known as a servicing company and Weitz said that he is not looking to turn UCS into a servicing company, he said that he is interested in doing more of this.

“It got me thinking that if there are any additional ISOs out there that aren’t growing, aren’t happily performing, or are just looking to get into something else, but have an existing book, UCS would look to service that as well,” Weitz said.

It turns out that BizBloom’s merchants are very similar to the ones that UCS services. And many of the merchants are funded by the same companies that UCS already has relationships with. When UCS opened in 2011, they initially brokered cash advance deals exclusively. But since then, they have added equipment financing, business term loans, business lines of credit and factoring, among other products. They service merchants in a variety of industries, from fitness centers to hotels to gas stations. According to Weitz, 98% of the company’s leads come from its internal marketing team.

Meet the Source: How Jared Weitz and United Capital Source became one of the industry’s fastest growing shops

October 23, 2015Jared Weitz came from humble beginnings and nearly settled for a humble fate. But associates say an ordinary, uneventful life wouldn’t have suited him – he works too hard and figures things out too quickly.

Almost ten years ago Weitz, 33, was parking cars to earn money for community college. After finishing at St. Johns University, he almost made plumbing his career. But now he’s CEO of United Capital Source LLC, an alternative-finance brokerage with deal flow of between $9 million and $10 million a month and an annual growth rate of over 65 percent.

Business associates, former bosses and his small cadre of employees all seem to revere Weitz for his honesty and straightforwardness. They consider him a personal friend. They say he continues to grow as a businessman and as a human being while taking pleasure in helping others do the same.

Geographically, Weitz has the good fortune to know where he belongs – the city of New York is in his DNA. “Every time I fly back,” he said, “I’m so happy to land.”

His love affair with the city began in Brooklyn. He was born there and raised in a Brighton Beach apartment in the shadow of Coney Island. When he was 16, the family moved to Oceanside on Long Island.

As the second of six children, Weitz had to come up with the money for college on his own. “My older sister and I had to pay our way,” he said. “Everybody else, my dad was able to cover.” He started school at Nassau Community College, selling cell phones and parking cars at night.

But then came an abrupt change. Once Weitz saved enough money, he transferred to Tulane University in New Orleans to pursue a relationship with a woman who was finishing her studies there. He attended classes part-time, worked as the athletic director at the Jewish Community Center, tended bar in a Mexican restaurant and served summonses for a law firm.

But then came an abrupt change. Once Weitz saved enough money, he transferred to Tulane University in New Orleans to pursue a relationship with a woman who was finishing her studies there. He attended classes part-time, worked as the athletic director at the Jewish Community Center, tended bar in a Mexican restaurant and served summonses for a law firm.

The relationship with the woman fizzled, but Weitz made lasting friendships during his days down south. His old roommate in New Orleans, who now practices law in Atlanta, serves as counsel for United Capital Source.

When Weitz had been in New Orleans for two years, Hurricane Katrina struck. He evacuated to Houston, where he stayed in a Holiday Inn for two weeks before realizing he wouldn’t be able to return to southern Louisiana anytime soon. The magnitude of the devastation was just too great.

Shouldering the duffel bag of belongings he had managed to pack on his back during the evacuation, he returned to New York, enrolled in St. John’s University and began working in sales for Honda Financial Services and parking cars.

Weitz had started school expecting to become a teacher. He had grown up with younger siblings and liked leadership roles, which convinced him teaching would be a good fit.

Still, many of his college jobs had required him to sell. As a bartender, for example, he promoted drink specials. As an athletic director he convinced people to sign up for classes. “Everything that I took to naturally wound up being in the sales, marketing and finance arena,” Weitz observed.

When he was nearly finished at St. John’s, Weitz was parking a car for an acquaintance who offered him a job as a union plumber. Suddenly, he was making $27 an hour and had health benefits. “It was a big breather for me,” Weitz recalled.

He quit his three jobs and labored as a plumber from 7 a.m. to 3 p.m. School started at 3:30 p.m. for him and stretched into the evening. But when he finished his degree, working as a teacher for $35,000 to $40,000 a year no longer seemed attractive.

Besides, his plumbing work didn’t center on toilets. On typical commercial plumbing jobs he did things like install air, medical and gas lines in hospitals. He was reading blueprints and bidding for jobs. A promotion to foreman didn’t seem that far off.

At about the same time, near the end of 2006, a friend, Mike Caronna, landed a job at Bizfi, formerly known as Merchant Cash and Capital (MCC), The company, which had just started and had only a few employees, was looking for underwriters.

As fate would have it, Weitz fell into a conversation with a fellow union plumber, one who had been on the job for 30 years. The older man reminded him that his wages would never climb much higher than they were right now. The veteran plumber then showed the younger man his hands, bent from decades of holding tools. “That got me thinking,” Weitz said.

He asked his friend Caronna to arrange a job interview at MCC. He got an offer and took a 90-day leave from his plumbing job to give the world of finance a try. “After about two weeks, I knew it was for me,” he said of the alternative-finance industry. It was by then the beginning of 2007.

Weitz excelled as an underwriter, and the company CEO, Stephen Sheinbaum, picked him and four others for a sales contest. Sheinbaum gave them some leads and turned them loose. Weitz won the competition but asked his boss to help him gain experience in business development and operations before taking on a sales position.

Sheinbaum was happy to comply. “He is one of the best and the brightest in the space,” he said of Weitz.

So, at age 25, Weitz found himself building a business development department by cultivating relationships with ISOs and persuading them to send business to MCC. “It was amazing,” he said of those days. “That was a big opportunity.”

Weitz learned the mechanics of the business. He found that the right ISO can originate good deals and a bad ISO can ruin deals. He learned the politics of when to talk, when to remain silent and when to let someone vent.

Then Weitz and a good friend at MCC, Anthony Giuliano – who’s now managing partner of Sure Payment Solutions – worked out how they could improve the MCC sales effort. They pitched Sheinbaum on the idea of having a second internal sale force, and that led to the birth of Next Level Funding (NLF), a division of MCC.

Weitz and Giuliano each owned 10 percent of NLF, and MCC owned 80 percent. “I’m 26, about to be 27, and I’m like, ‘You did it, Man,’” Weitz said as he looked back.

After about four months, NLF absorbed MCC’s original sales division. Next, Giuliano and another executive, Paul Giuffrida, decided to leave MCC. Weitz felt torn. He felt an allegiance to Giuliano and respected Giuliano’s knowledge of programming – a subject that was alien to him. Yet Sheinbaum had provided Weitz a series of opportunities.

Weitz stayed at MCC but felt he deserved to become chief sales officer. When that didn’t happen, he sold his shares back to the company at a dramatically reduced price to extricate himself from a non-compete clause and set off to start United Capital Source (UCS).

With a five-figure investment, Weitz and his then partner, started UCS in January of 2011 in a 250-square-foot office in Long Beach, L.I. Weitz invested about 90 percent of the money he had saved while working at MCC.

Jon Baum left NLF with Weitz and became the first UCS employee. Within a week or two, Danielle Rivelli, left NLF to join UCS, and Weitz put the remaining 10 percent of his savings into the business to meet the expanded payroll. Today, Baum and Rivelli are UCS sales managers.

Jon Baum left NLF with Weitz and became the first UCS employee. Within a week or two, Danielle Rivelli, left NLF to join UCS, and Weitz put the remaining 10 percent of his savings into the business to meet the expanded payroll. Today, Baum and Rivelli are UCS sales managers.

The first month UCS was open, it funded $240,000 in deals. “It just felt good to be on my own and start funding deals,” Weitz said. From the beginning of UCS, he won praise from funders for bringing them the right kind of deals with merchants who were likely to repay.

“He really has the pulse of the marketplace and what a lender is looking for,” said Todd Sherer, who handles business development for Entrepreneur Growth Capital. “He doesn’t waste time giving you transactions that don’t fit in your box.”

That’s because doing things right means a lot to Weitz. “He is one of the most straightforward, honest, high-integrity people I have met in the industry,” said Steven Mandis, adjunct associate professor at the Columbia University Business School and chairman of Kalamata Capital LLC.

He’s won the OnDeck seal of approval. “OnDeck has a rigorous and extensive background check process as part of our broker certification process,” said Paul Rosen, OnDeck’s chief sales officer. “Jared Weitz and United Capital have passed our screens and process and are currently active brokers for OnDeck.”

And with time, Weitz has learned patience. He was sometimes short with funders when he started his company but has matured into a pleasant person to deal with, said Heather Francis, CEO of Elevate Funding. “I’ve seen that growth with him,” she said.

All of those good qualities soon came together to help UCS succeed. Within four months of its launch, the company rented a 1,500-square-foot office in Garden City and hired two more people. Next came a 3,200-square-foot office in Rockville Centre and three more employees.

“The company was growing and gaining traction,” Weitz recalled. “I bought out my original partner.” Since then, Vincent Pappalardo has invested in UCS and become a minority partner.

Meanwhile, the lease was expiring on Long Island, and Weitz felt the time had come to move to Manhattan. That would enable the company to draw employees from throughout the region and not just Long Island.

“We decided to bite the bullet and pay the excess money to move to the city because we believed it would be better for the business,” Weitz said. He added two people and rented a 5,500-square-foot space near Penn Station in the Garment District in September of 2014.

Within three months of making the move to Manhattan, business doubled. “Being in a faster-paced environment caused the business to go through another growth phase,” he said. After nine months in the city, UCS is now taking over a whole 8,500-square-foot floor of the same building.

Within three months of making the move to Manhattan, business doubled. “Being in a faster-paced environment caused the business to go through another growth phase,” he said. After nine months in the city, UCS is now taking over a whole 8,500-square-foot floor of the same building.

UCS remains a small shop in terms of headcount with 21 people, but the company’s funding numbers equal the output of many brokerages five times its size. Twelve of the UCS employees work in sales, with the others engaged mainly in underwriting, operations and customer service.

Less than 2 percent of UCS’s funding volume comes from broker business. “We self-generate all of our business,” Weitz said, declining to elaborate too much on his company’s marketing efforts.

“My salespeople – bar none – are the best in the industry,” he claimed. “Much like the Navy has the SEALS and the Army has the Rangers, there are groups in the industry that can do triple or quadruple what other people do because that’s just the way they are.” His people fund an average of $750,000 per month per person in new business, while his renewals reps fund well into the 7-figure range per person.

UCS salespeople achieve their results because they have detailed knowledge of the industry, Weitz said. The staff’s understanding of alternative finance doesn’t end with sales but also includes underwriting and finance, he noted. “That’s what makes you a very good and knowledgeable sales rep,” he maintained.

His salespeople don’t just tell a client what he or she wants to hear. They take the time to understand the client’s financial situation. “They know how to read a profit and loss statement, a balance sheet and tax returns,” Weitz said.

ARE THE BEST IN THE INDUSTRY”

While 90% of Weitz’s sales team has a college degree, most of the salespeople have come from outside the industry, he said, noting that one was with Sleepy’s, the mattress company. Another was selling memberships at a gym, one worked for a credit card processing company, two were barbers and one had just graduated from college.

UCS doesn’t make double-digit commissions because the company isn’t over-charging merchants, Weitz maintained. The company does not obtain excess funding that a customer can’t afford or increase the factor rate to dangerous levels, he noted.

“You’re not really helping the merchant” by providing too much capital, Weitz asserted. “You’re sucking the blood out of him before he goes away. That’s not why I’m in business.”

A clean record will also prove beneficial when federal regulation comes to the industry, he said. Integrity in the workplace can also spill over into other parts of a person’s life, Weitz believes.

As UCS grew larger and Weitz grew older, he saw his employees rent their first apartments and then buy their first homes. He learned then that he had taken on more responsibility than was apparent to him at first.

As UCS grew larger and Weitz grew older, he saw his employees rent their first apartments and then buy their first homes. He learned then that he had taken on more responsibility than was apparent to him at first.

To accommodate the employees he added a human relations department and commissioned a company handbook. He’s also started marketing, finance, operations and other departments.

He’s lost only four employees because he pays them well, respects their time and doesn’t view their youth as a liability.

Meanwhile, talking daily to merchants and hearing about their heartaches and triumphs has humbled and matured Weitz. Seeing how the merchants’ choices panned out or fell short also shaped him and helped him grow up a little, he said.

Weitz has found time in his 70-hour workweek to meet his future bride. They’re planning to wed next year, and he plans to invite his entire staff. “It wouldn’t feel right without them,” he said.

Weitz has skipped the Ferrari, Rolls Royce and mansion because he didn’t feel he needed them. But even without those status symbols, it’s clear that Weitz has avoided settling for a humble fate.

As for what comes next, UCS is said to be developing an online marketplace to take their business to the next level, though Weitz declined to provide specific details about how it will work. “We’re on pace to do more than $100 million worth of deals a year,” Weitz said. “And as far as we’ve come, I feel like this is still just the beginning.”